How do I manage my finances while still a college student? When it comes to budgeting, most students are stuck in the painful process of trial and error. Indeed, controlling your finances can be tricky, especially if you have to cover attendance, repay your loan, and handle unexpected expenses. Yet, everything is possible if you create a proper budget.

You might be surprised to learn that your smartphone can do all the boring budgeting tasks for you. You no longer need to jot down all your expenses manually. Apps keep track of everything you earn and spend without wasting any of your precious time. In this article, you’ll find eight must-have apps for managing your finances as a student.

Page Contents

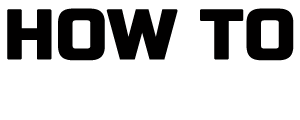

1. Plum

Plum is an app for your financial well-being. The app will analyze your income and spending to provide you with an overview of your finances. You can make deposits to ensure you have enough saved for things you enjoy most, like traveling. Yes, it’s possible to travel and study at the same time if you have a good paper writing service to deal with homework and write essays and an app to keep your finances in check. So try Plum to increase your savings.

Pricing: Free.

2. Mint

Are you looking for ways to track your expenses and spend smarter? Mint makes budgeting fast and simple. The app synchronizes with your financial accounts. So you can see your credit cards, subscriptions, investments, and loans in one place. What makes Mint special?

- It’s an all-in-one solution.

- It offers mintsights, which are personalized recommendations on how you can improve your budgeting strategy.

- You get reminders when you’re getting close to exhausting your monthly budget or need to pay bills.

- The app provides money-saving options.

Pricing: Free.

3. EveryDollar

If you struggle to track where your money goes, you should be downloading EveryDollar right now. It makes student budgeting easy by tracking all your expenses, due dates, and balances.

When you see how much you spend per category, you can customize your budget. With set priorities, you make sure you have enough funds to binge-watch your favorite series, save on big purchases, and get domyessay.com help online. A budget is a highly personal matter, so EveryDollar offers personalized payment plans to help you enjoy things you like and start saving at the same time.

Pricing: 14-day free trial, Premium Plan starts at $59.99 per 3 months.

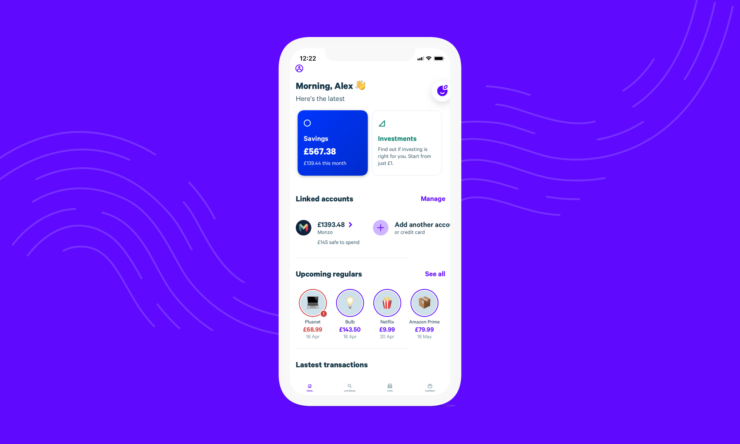

4. Wally

Financial goals become much easier to reach with Wally. It is an end-to-end encrypted app for managing personal finances. What are the advantages of using Wally?

- You can set a budget by category, like groceries, entertainment, etc., and have limits for flexible budget periods.

- Wally provides you with insights on your progress so you can see real-time cash flow and optimize your habits accordingly.

- You become more organized as you can get your personal financial calendar and use Wally to store your documents like bills and receipts.

- Wally supports joint accounts so you can use them together with your partner, friend, or roommate.

Pricing: Free. Wally Premium For Life costs $74.99.

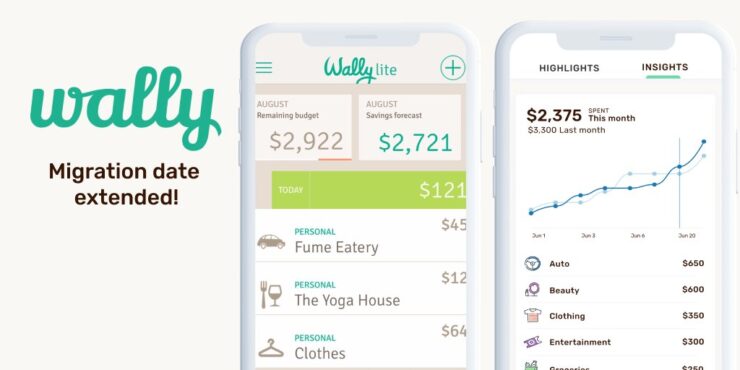

5. YNAB (You Need A Budget)

Want to increase your financial stability? You need a budget. YNAB exists specifically to help you get your finances in order. It introduces you to its unique four-step method that helps you gain control over the money you earn and spend. It teaches you how to:

- Spend money with confidence;

- Embrace your true expenses;

- Address overspending;

- Consistently spend less than you earn.

Pricing: 34-day free trial, Premium Plan costs $14.99 per month.

6. Splitwise

This app is designed to handle shared expenses. If you share an apartment with a roommate, split bills with friends, or need an app to manage your family funds, Splitwise is exactly what you’ve been looking for. It takes away all the stress and makes sharing quick and easy. You can do it on the go and never forget to pay your friends back or get paid. The app also has a premium version with some advanced features like currency conversion, receipt scanning, charts, and more.

Pricing: Free. Splitwise Pro costs $3 per month.

7. PocketGuard

Do you often overspend? If the answer to this question is yes, then PocketGuard might be the perfect budgeting app for you. With this app, you can connect all your bank accounts and cards, set aside funds for necessities, track your spending, and even save money.

The app is pretty simple and does most of the work for you, making it ideal for students. Its intuitive pie chart allows you to see all your expenses in one place and help you determine what eats up the most of your budget. The app also allows you to personalize your chart with custom categories and hashtags. The PocketGuard Autosave feature enables you to set savings goals and automatically transfer money to your savings account. What are the other cons of using PocketGuard?

- With the In My Pocket feature, you can analyze your income, expenses, and savings and determine how much is available for everyday spending.

- The app’s tracking feature can help you negotiate better deals on your cable, cell phone, and other bills.

- The app allows you to determine whether you can make a costly purchase based on your budget.

- The app’s algorithms help you identify areas where you can save money.

Pricing: Free. PocketGuard Plus costs $7.99 per month or $34.99 per year. You can also

make a one-time lifetime purchase for $79.99.

8. Goodbudget

An envelope budgeting system is now available on your smartphone with Goodbudget. It’s a time-tested method empowered with digital features like sync and share. How does it work? Every month you create envelopes with money you need for a particular category of your expenses. Thus, you don’t track your spending. You plan it. This system allows you to save money for holidays, trips, presents, and dream purchases.

Pricing: Free. Goodbudget Plus costs $7 per month.

Wrapping Up

Better spending habits, preparedness for emergencies, and decreased financial stress. Who doesn’t want these benefits that come with an effective budget? Use our article as an inspiration to embrace digital budgeting practices and find your perfect app for managing finances.